Introduction

On 18 December 2020, the Organization for Economic Co-operation and Development (OECD) issued its guidance (referred to as the “Guidance”) on the transfer pricing implications of the COVID – 19 pandemic. The Guidance represents the consensus view of the 137 members of the inclusive framework on Base Erosion and Profit Shifting (BEPS) regarding the application of the arm’s length principle and the OECD transfer pricing guidelines 2017 (TPG) to issues that may arise or be exacerbated in the context of the COVID – 19 pandemic.

The Guidance should be regarded as an application of the existing guidance under the OECD TPG to facts and circumstances that may arise commonly in connection with the COVID – 19 pandemic and hence does not provide a mechanical approach to adjust transfer prices.

Four issues are discussed in the Guidance (i) comparability analysis; (ii) losses and the allocation of COVID-19 specific costs; (iii) government assistance programmes; and (iv) advance pricing agreements.

In this article we focus on comparability analysis.

Comparability analysis

The pandemic may have a significant impact on the pricing of some transactions between independent enterprises and may reduce the reliance that can be placed on historical data when performing comparability analyses. Practical approaches which are consistent with the transfer pricing policy of the taxpayer need to be considered to address the deficiencies in comparability.

A multiyear agreement covering year 2020 may not require a comparability analysis in that year provided the facts and circumstances of the controlled transaction remain unchanged in 2020. Since the COVID-19 pandemic has created economic conditions that often differ from those of previous years, it may be necessary to review the suitability of these existing comparables and potentially in some cases, it may be useful to revise the set based on updated search criteria.

An annual agreement will certainly require a comparability analysis.

Below we consider some of the factors to consider for FY 2020 when undertaking the comparability analysis.

Use of loss making comparables

In general, there is no overriding rule on the inclusion or exclusion of loss making comparables in the OECD TPG, thus, loss making comparables that satisfy the comparability criteria in a particular case should not be rejected on the sole basis that they suffer losses in periods affected by the COVID – 19 pandemic.

When performing a comparability analysis for FY 2020, it may be appropriate to include loss-making comparables when the accurate delineation of the transaction indicates that those comparables are reliable.

However, there are jurisdictions, for instance Saudi Arabia, which does not allow the use of loss-making companies in comparability analysis. It remains to be seen if these jurisdictions will be issuing separate guidance and the approach which will be taken with regards to loss making comparables.

Establishing appropriate period of data

As a pragmatic means of addressing divergent economic conditions in the pre- or post-pandemic period, and when the pandemic was in effect and its effects on economic conditions were material, the Guidance endorses separate testing periods for the duration of the pandemic or for the period when certain material effects of the pandemic were most evident. This approach, however, may be appropriate, so long as the data from independent comparables can be measured over a similar period in a consistent manner.

In addition, government intervention in a market should also be considered while performing a comparability analysis. For example, assume, that government intervention forces a taxpayer to close its distribution facilities for three months. In undertaking a benchmark analysis, care should be taken in verifying that comparable enterprises have faced similar restrictions or conditions. Otherwise, it might be necessary to adjust the period over which the comparison is performed (e.g. excluding the economic data corresponding to the three months where the taxpayer was unable to operate).

Whilst in some fact patterns it is appropriate to use separate or more carefully circumscribed testing periods, in other circumstances the use of combined periods (that include both years that are impacted by the pandemic and years that are not impacted) may improve reliability. This approach would aggregate the financial results of FY 2020, which may be exceptional, with the more normal results of prior years in order to test the arm’s length nature of the transfer pricing policy applied in FY 2020.

Practical approaches available to address contemporaneous information deficiencies

As the economic circumstances caused by the pandemic are continuing and evolving over time, taxpayers may encounter difficulties in determining arm’s length conditions due to the lag in time between the occurrence of controlled transactions and the availability of information regarding contemporaneous uncontrolled transactions or companies.

The guidance offers some pragmatic approaches to dealing with the defiencies in the availability of contemporaneous information. These include

The use of reasonable commercial judgement supplemented by contemporaneous information to set a reasonable estimate of the arm’s length price

In the determination of a reliable arm’s length outcome, flexibility and the exercise of good judgment is required. In undertaking reasonable and appropriate due diligence in evaluating the likely effects of the COVID-19 pandemic and in implementing appropriate changes in their transfer prices, MNE groups should document the best available market evidence currently available, which may be in the form of internal comparables, external comparables, or other relevant evidence of the economic impact of the COVID – 19 pandemic, including its effects on the level of demand for goods and services, and on production and supply chains in particular sectors of the economy.

Allow for arm’s length outcome testing approach

The OECD TPG describe two approaches to identify and collect data required to undertake a transfer pricing analysis. The first is a “price-setting,” i.e. an ex-ante approach, which uses historical data updated to reflect any change in economic conditions through the date of the contract. The second is an “outcome-testing” approach, which may incorporate information that becomes available after the close of the taxable year to determine arm’s length conditions and report results on the tax return.

The Guidance asserts that where possible, and on a temporary basis during the pandemic, tax authorities that otherwise use the price-setting approach could consider allowing taxpayers, for those controlled transactions

affected by the pandemic, to take into account information that becomes available after the close of the taxable

year in filing their returns (where legally permissible and properly described in the transfer pricing documentation).

Tax authorities could provide flexibility to allow amendments to FY 2020 tax returns such that transfer prices are set on an arm’s length basis and using available information. Furthermore, given the potential for double taxation that may arise as a result of unilateral adjustments, consideration may be given by tax authorities to:

- Provide for flexibility in the allowance of “compensating adjustments” to be made before the tax return is filed, where it is legally permissible, in order to allow for any available contemporaneous information to be better evaluated by taxpayers and tax authorities such that arm’s length prices can be reliably established; or

- Ensure access to the Mutual Agreement Procedure (MAP), or to some alternative applicable procedure.

Use of more than one transfer pricing method

The Guidance endorses the application of more than one transfer pricing method to corroborate the arm’s length price of a controlled transaction.

- Use of budgeted financial information

The financial outcomes that taxpayers within a controlled transaction would have achieved ‘but for’ the impact of COVID – 19 pandemic may provide useful information, particularly when assessing the financial impacts from COVID-19 pandemic (e.g. reduced sales volume or increased operating expenses) and determining, in light of contractual terms and risk assumption of the parties, any appropriate resulting impact on inter-company prices.

The “but for” approach was included in the Australian Tax Authority guidance on TP approaches which can be adopted for 2020 in light of the COVID – 19 pandemic.

- Sources of contemporaneous information which may be used to support the comparability analysis for FY 2020

In principle, any form of publicly available information regarding the effect of COVID – 19 pandemic on the business, industry and controlled transaction may be relevant in ascertaining the arm’s length nature of an enterprise’s transfer pricing policy implemented for FY 2020.

The following sources of information may support that determination through the comparability analysis, generally by estimating the effect of the COVID – 19 pandemic on the controlled transactions under review:

- An analysis of how sales volumes have changed during COVID – 19 pandemic, including whether the change is due to the use of other sales channels, and specifically compared to sales generated in pre-COVID years;

- An analysis of the change in capacity utilisation relevant for the MNE group and the controlled transaction, and/or transactions with independent parties;

- Specific information relative to incremental or exceptional costs borne by parties to the controlled transaction (either with associated or unrelated parties) or by the MNE group as a whole;

- The extent to which government assistance has been received and, if so, quantifying the effect and identifying the type of the assistance and its accounting treatment;

- Details regarding government interventions that have affected the pricing and performance of controlled transactions;

- Information from interim financial statements such as quarterly Securities and Exchange Commission (SEC) filings or earnings releases;

Relevant macroeconomic information like country specific Gross Domestic Product (GDP) data or industry indicators from central banks, government agencies, industry or trade associations;

- Statistical methods such as regression analysis or variance analysis that are used to predict the extent to which a certain variable will vary with reference to other variables under certain specific conditions (e.g. the response of corporate profits in certain industries to GDP movements);

- A comparison of internal budgeted/forecasted data relating to sales, costs and profitability, compared to actual results; and

- An analysis of the effects on profitability or on third party behaviour observed in previous recessionary periods or using any data available in the current year, even if partial.

- Price adjustment mechanisms

The Guidance proposes price adjustment mechanisms in controlled transactions. This may provide for flexibility while maintaining an arm’s length outcome. In particular, this approach to the extent permissible by domestic law, would allow the adjustment of prices relevant for FY 2020 through adjusted invoicing or intercompany payments effectuated in a later period (likely FY 2021), when more accurate information to establish the arm’s length transfer price becomes available. However, these adjustments can have VAT/GST and customs duty implications and so particular attention is required as to their appropriate characterisation.

- Use of data from other financial crises to support price setting/testing

The guidance does not recommend the use of financial information from the global financial crisis (FY 2008/2009) to perform a comparability analysis for FY 2020 as the implications of the pandemic have been very different to those experienced during the financial crisis.

Illustration of an example

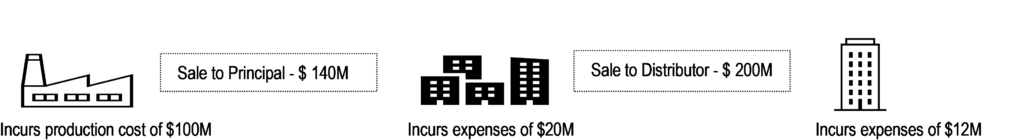

To illustrate the points above, the below fictitious example is used to show related party transactions in normal circumstances:

The table 1 below shows the transactions between the parties. Consolidated profits during normal periods are $118 M, allocated among the affiliates by the transfer pricing policies. The appropriate distribution operating margin is 15% of sales, which has been supported by a TNMM analysis. We have also assumed that the appropriate mark-up over production costs for the manufacturing affiliate is 40%, which is supported by another TNMM analysis.

| USD Millions | Consolidated | Distributor | Principal | Manufacturer |

| Sales | 250 | 250 | 200 | 140 |

| Cost of sales | 100 | 200 | 140 | 100 |

| Gross profits | 150 | 50 | 60 | 40 |

| O. Expenses | 32 | 12 | 20 | 0 |

| Profits | 118 | 38 | 40 | 40 |

With the impact of the COVID – 19 pandemic, we assume that production costs have risen from 40% of sales to 50% of sales (i.e., 40% vs 50% of $250M), and total operating expenses have risen from 13% of sales to 25% percent of sales (32M/250M vs 62M/250M), which lowers the consolidated operating margin from 47% to 25% (118M/250M vs 62M/250M). The ratio of operating expenses to total expenses remain unchanged for both the distributor and principal.

Table 2, Scenario A, assumes that the reduction in profits is allocated to not only the principal but also to the distribution and manufacturing affiliates. These transfer pricing policies would appear to not be aligned with the TNMM approaches originally conducted to defend the transfer pricing policies during normal periods.

TABLE 2- Scenario A

| USD Millions | Consolidated | Distributor | Principal | Manufacturer |

| Sales | 250 | 250 | 200 | 140 |

| Cost of sales | 125 | 200 | 140 | 125 |

| Gross profits | 125 | 50 | 60 | 15 |

| O. Expenses | 63 | 23 | 40 | 0 |

| Profits | 62 | 27 | 20 | 15 |

Multinationals with transfer pricing policies resembling scenario A may find documenting their policies as being arm’s length difficult as such documentation will need to go beyond the standard applications of TNMM. The guidance recommends the use of any form of publicly available information regarding the impact of the pandemic on the multinational, its intercompany transactions, or general industry considerations. This information may include how the pandemic affected sales for the distribution affiliates or the capacity utilization of the manufacturing affiliates. This information could include any exceptional costs borne by the affiliate and the impact of government assistance received.

Such information might allow an analysis to rely on internal budgeted sales and expenses rather than actual results for the purposes of a TNMM analysis.

Another scenario, labelled as scenario B, assumes that transfer prices are reduced for the distribution affiliate and increased for the manufacturing affiliate such that they receive the profit margins as during the normal period (i.e., 15% for the distributor and 29% for the manufacturer) even though consolidated profits have dramatically declined. Scenario B reflects the extreme version of the limited risk entity concept.

TABLE 2- Scenario B

| USD Millions | Consolidated | Distributor | Principal | Manufacturer |

| Sales | 250 | 250 | 190 | 175 |

| Cost of sales | 125 | 190 | 175 | 125 |

| Gross profits | 125 | 60 | 15 | 50 |

| O. Expenses | 63 | 23 | 40 | 0 |

| Profits | 62 | 37 | (25) | 50 |

Conclusion

The Guidance acknowledges that the economic impact of the COVID-19 pandemic varies widely across economies, industries, and businesses, which is a key factor when considering and interpreting its content. Therefore, in any transfer pricing analysis of the implications of the COVID-19 pandemic, businesses should seek to document contemporaneously the impact at granular level.

The objective of finding a reasonable estimate of an arm’s length outcome requires an exercise of judgment on the part of taxpayers and tax administrations.

The comments in this article are for general information and are not intended as advice. Readers should seek professional advice where relevant.